# install.packages("ardl.nardl")

library(ardl.nardl)Warning: package 'ardl.nardl' was built under R version 4.4.3Registered S3 method overwritten by 'quantmod':

method from

as.zoo.data.frame zoo # install.packages("ardl.nardl")

library(ardl.nardl)Warning: package 'ardl.nardl' was built under R version 4.4.3Registered S3 method overwritten by 'quantmod':

method from

as.zoo.data.frame zoo # Data

datanardl <- read.csv("Data/Bab 9/datanardl.csv")

head(datanardl) date price.Vietnam price.China

1 1/1/2002 115 143.7978

2 2/1/2002 105 129.4568

3 3/1/2002 100 127.9081

4 4/1/2002 117 149.8740

5 5/1/2002 103 131.0987

6 6/1/2002 113 145.1878# Phillips-Perron Unit Root Test

PP.test(datanardl$price.Vietnam)

Phillips-Perron Unit Root Test

data: datanardl$price.Vietnam

Dickey-Fuller = -5.6063, Truncation lag parameter = 3, p-value = 0.01PP.test(datanardl$price.China)

Phillips-Perron Unit Root Test

data: datanardl$price.China

Dickey-Fuller = -5.0955, Truncation lag parameter = 3, p-value = 0.01# Auto Selecet Model

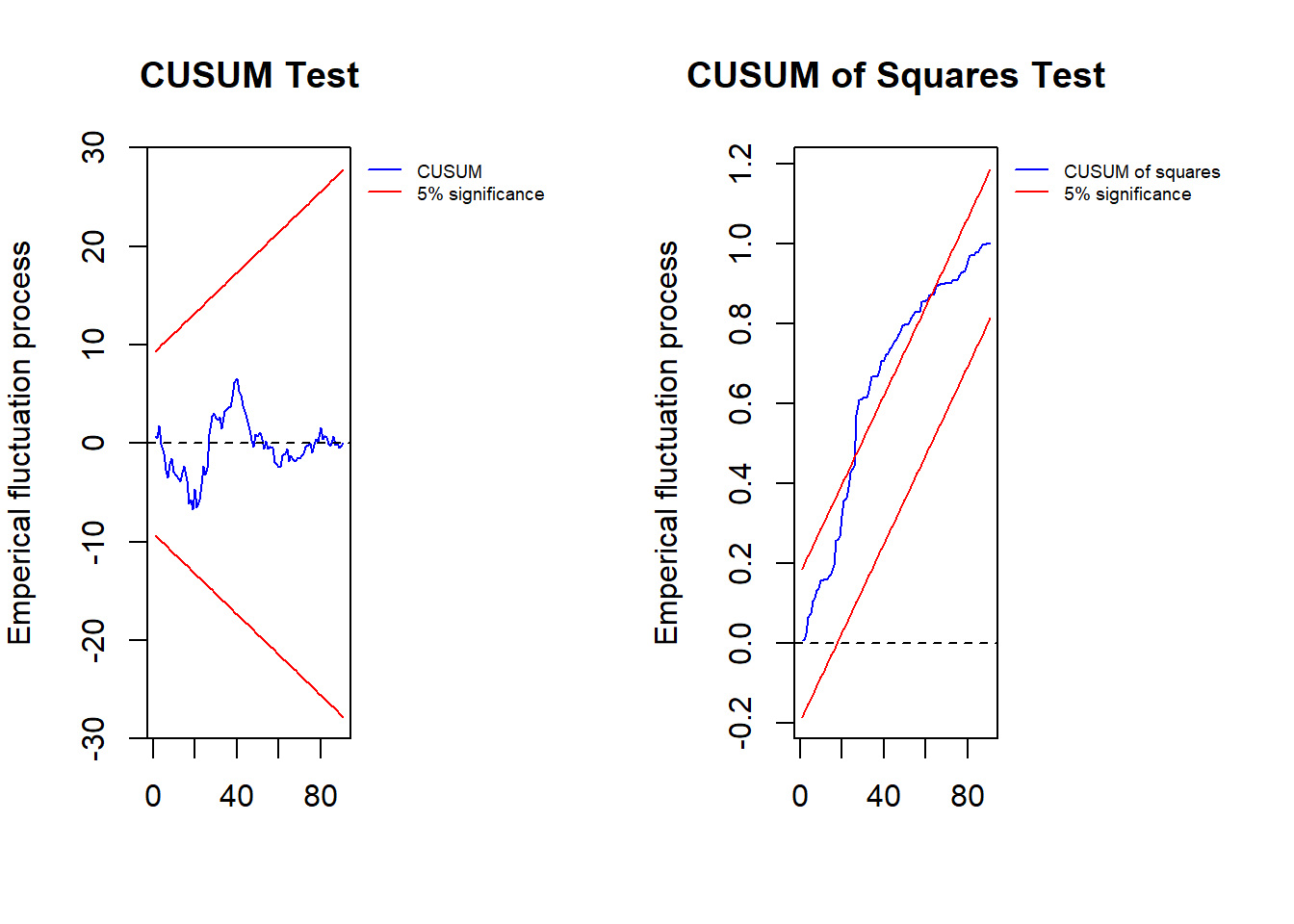

model1 <- gets_nardl_uecm(x = datanardl,

decomp = 'price.China',

dep_var = 'price.Vietnam',

p_order = c(5),

q_order = c(5),

graph_save = TRUE,

case = 3,

F_HC = TRUE)Percentage of positive changes in decomp is 56 percent while negative change is 44

# Cointegratio Test

model1$cointegration$Fstat observation k fstat case lower.b upper.b

10% critical value 91 1 10.88198 3 4.04 4.78

5% critical value 91 1 10.88198 3 4.94 5.73

1% critical value 91 1 10.88198 3 6.84 7.84# NARDL Form

summary(model1$Parsimonious_NARDL_fit)

Call:

lm(formula = price.Vietnam ~ price.Vietnam_1 + price.Vietnam_3 +

price.Vietnam_4 + price.Vietnam_5 + price.China_pos + price.China_pos_1 +

price.China_pos_2 + price.China_pos_4 + price.China_pos_5 +

price.China_neg + price.China_neg_1 + price.China_neg_4 +

price.China_neg_5, na.action = na.exclude)

Residuals:

Min 1Q Median 3Q Max

-16.3047 -4.4665 -0.3095 4.0691 21.2637

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 66.70011 14.83287 4.497 2.40e-05 ***

price.Vietnam_1 0.52746 0.09462 5.575 3.52e-07 ***

price.Vietnam_3 0.14052 0.10138 1.386 0.16974

price.Vietnam_4 -0.03782 0.10453 -0.362 0.71847

price.Vietnam_5 -0.14259 0.09817 -1.452 0.15043

price.China_pos 0.08230 0.18191 0.452 0.65223

price.China_pos_1 -0.28087 0.22492 -1.249 0.21553

price.China_pos_2 0.19196 0.17400 1.103 0.27338

price.China_pos_4 -0.26694 0.19885 -1.342 0.18341

price.China_pos_5 0.25245 0.16491 1.531 0.12991

price.China_neg 0.04123 0.15263 0.270 0.78778

price.China_neg_1 0.05460 0.17787 0.307 0.75969

price.China_neg_4 -0.50597 0.17240 -2.935 0.00440 **

price.China_neg_5 0.41552 0.15347 2.708 0.00835 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 7.061 on 77 degrees of freedom

Multiple R-squared: 0.5657, Adjusted R-squared: 0.4923

F-statistic: 7.714 on 13 and 77 DF, p-value: 1.571e-09# NARDL ECM Form

summary(model1$Parsimonious_ECM_fit)

Call:

lm(formula = D.price.Vietnam ~ price.Vietnam_1 + price.China_pos_1 +

price.China_neg_1 + D.price.Vietnam_2 + D.price.Vietnam_3 +

D.price.Vietnam_4 + D.price.China_neg_4, na.action = na.exclude)

Residuals:

Min 1Q Median 3Q Max

-16.0510 -5.0380 -0.3461 3.9997 23.1158

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 61.8968384 11.5905403 5.340 7.95e-07 ***

price.Vietnam_1 -0.5138343 0.0903867 -5.685 1.90e-07 ***

price.China_pos_1 -0.0192273 0.0771006 -0.249 0.8037

price.China_neg_1 0.0003975 0.0741449 0.005 0.9957

D.price.Vietnam_2 0.0790419 0.0929207 0.851 0.3974

D.price.Vietnam_3 0.2409279 0.0963186 2.501 0.0143 *

D.price.Vietnam_4 0.1413008 0.0922292 1.532 0.1293

D.price.China_neg_4 -0.5632653 0.1217687 -4.626 1.36e-05 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 7.093 on 83 degrees of freedom

Multiple R-squared: 0.4579, Adjusted R-squared: 0.4122

F-statistic: 10.01 on 7 and 83 DF, p-value: 5.192e-09# Long Run Coefficients

model1$Longrun_relation Estimate Std. Error t value Pr(>|t|)

price.China_pos_1 -0.0374192226 0.1505206 -0.248598606 0.8042781

price.China_neg_1 0.0007735328 0.1442840 0.005361181 0.9957351# Long Run Asymetric Test

model1$longrun_asym Fstat Pval

price.China 5.031109 0.02756084# Short Run Asymetric Test

model1$Shortrun_asym Fstat Pval

price.China 21.39708 1.359712e-05